What is Partner Relationship Management (PRM)?

Enabling an internal sales team is hard enough. Enabling a network of external partners, each with their own organizational culture, market focus, and way of doing business, is a different problem entirely. Your internal team shares your systems, your training infrastructure, your communication channels. Partners have none of that by default. They operate at arm’s length, often across different geographies and time zones, representing your products alongside those of other vendors who are competing for their attention.

The companies that do channel well have figured out how to extend the same rigor they apply to internal enablement outward to their partners. They provide structured onboarding that does not require hand-holding from an already-stretched channel team. They deliver training and certification that partners can complete on their own schedule. They make content, pricing, and program information accessible without requiring partners to ask for it. And they do this in a way that accounts for the fact that a VAR in Germany and a systems integrator in Brazil and a managed service provider in Singapore all need different things.

Partner relationship management (PRM) is the category of software that makes this kind of scaled enablement possible. The term refers both to the discipline of managing partner relationships systematically and to the platforms that operationalize that discipline. PRM software provides the infrastructure that lets you treat your partner ecosystem with the same intentionality you bring to your internal go-to-market organization: portals where partners access resources and register deals, learning systems where they complete training, workflows that route leads and manage approvals, and analytics that show you what is working.

This guide walks through how PRM works in practice: what distinguishes it from CRM, what types of partners exist, what features matter in a platform, and how to think about measuring success. Whether you are evaluating PRM software for the first time or reconsidering your current approach, the goal is to give you a clear picture of what this category does and where it fits.

What is partner relationship management?

Partner relationship management refers to the combination of strategy and technology that companies use to manage their relationships with channel partners: resellers who sell your products directly to customers, referral partners who introduce you to new opportunities, service providers who implement your solutions, and many other configurations. At its core, PRM is about creating structure around these relationships so they can scale. Without that structure, channel programs tend to devolve into a collection of one-off arrangements, each managed differently, with inconsistent communication, unclear expectations, and limited visibility into performance.

The strategy side of PRM involves decisions about partner recruitment, tiering, incentives, enablement, and measurement. These are questions that exist independent of any particular software: What kind of partners do you want to attract? What do you expect from them, and what will you provide in return? How will you segment partners into different tiers with different benefits? How will you measure success?

The software side of PRM provides the tools to execute that strategy consistently across a large partner base. A PRM platform typically includes:

- A partner portal where partners log in to access resources, register deals, and complete training

- An administrative interface where your team manages the partner program

- Integrations with other systems like CRM platforms and marketing automation tools

- Analytics to measure partner performance and program health

Some organizations refer to PRM as “channel management” or “partner management” software. The terminology varies, but the core function is the same: providing infrastructure for indirect sales channels. PRM software complements human relationships rather than replacing them; building trust, negotiating contracts, and resolving disputes still require personal attention, but the software provides scaffolding that frees you to focus on those high-touch activities by handling the operational complexity at scale.

The partner lifecycle: what PRM manages

A useful way to understand PRM is through the lens of the partner lifecycle. From first contact to ongoing performance management, a partner relationship moves through several stages. Each stage presents distinct challenges, and PRM software provides tools to address them.

Recruitment

Partner recruitment involves identifying organizations that align with your go-to-market strategy and convincing them to work with you, which is often easier said than done in competitive markets where quality partners have their pick of vendors.

PRM platforms support recruitment by providing application forms, lead capture mechanisms, and workflows for processing incoming partner inquiries. Some platforms include partner locator tools that let prospective partners find you through your website. But the strategic work of recruitment happens outside the software. You need to define your ideal partner profile: What geographies, industries, or customer segments should they serve? What capabilities should they have? What size and maturity of organization is a good fit?

Effective recruitment also requires understanding what motivates partners, because the best partners have options and are evaluating you as much as you are evaluating them. Your ability to articulate a compelling partner value proposition (more on this later) determines whether quality partners join your program or go elsewhere.

Enrollment and onboarding

Once a partner agrees to work with you, the relationship needs to be formalized: enrollment involves collecting necessary information, executing contracts, and provisioning access to your systems. Partner onboarding is where the relationship either gains momentum or stalls. New partners need to learn about your products, understand your processes, and get access to the resources they need to be effective. A poor onboarding experience signals that you do not take the partnership seriously. PRM platforms typically provide structured onboarding workflows: welcome sequences, document collection, initial training assignments, and introductions to key contacts. The goal is to move partners from signup to productivity as quickly as possible while ensuring they have the knowledge they need to represent your brand well.

Enablement

Enablement is the ongoing work of preparing partners to sell, market, and support your products through training, certification, content distribution, and access to sales tools. Training and certification are particularly important in technical industries where partners need to demonstrate competency before they can effectively position your solutions. PRM platforms with built-in learning management systems allow you to create courses, track completion, issue certifications, and tie training progress to partner tier requirements.

Beyond formal training, enablement includes providing partners with the materials they need: product documentation, competitive positioning guides, pricing information, case studies, and sales presentations. A well-organized content library within your PRM ensures partners can find what they need without submitting support tickets or waiting for email responses.

Pipeline management

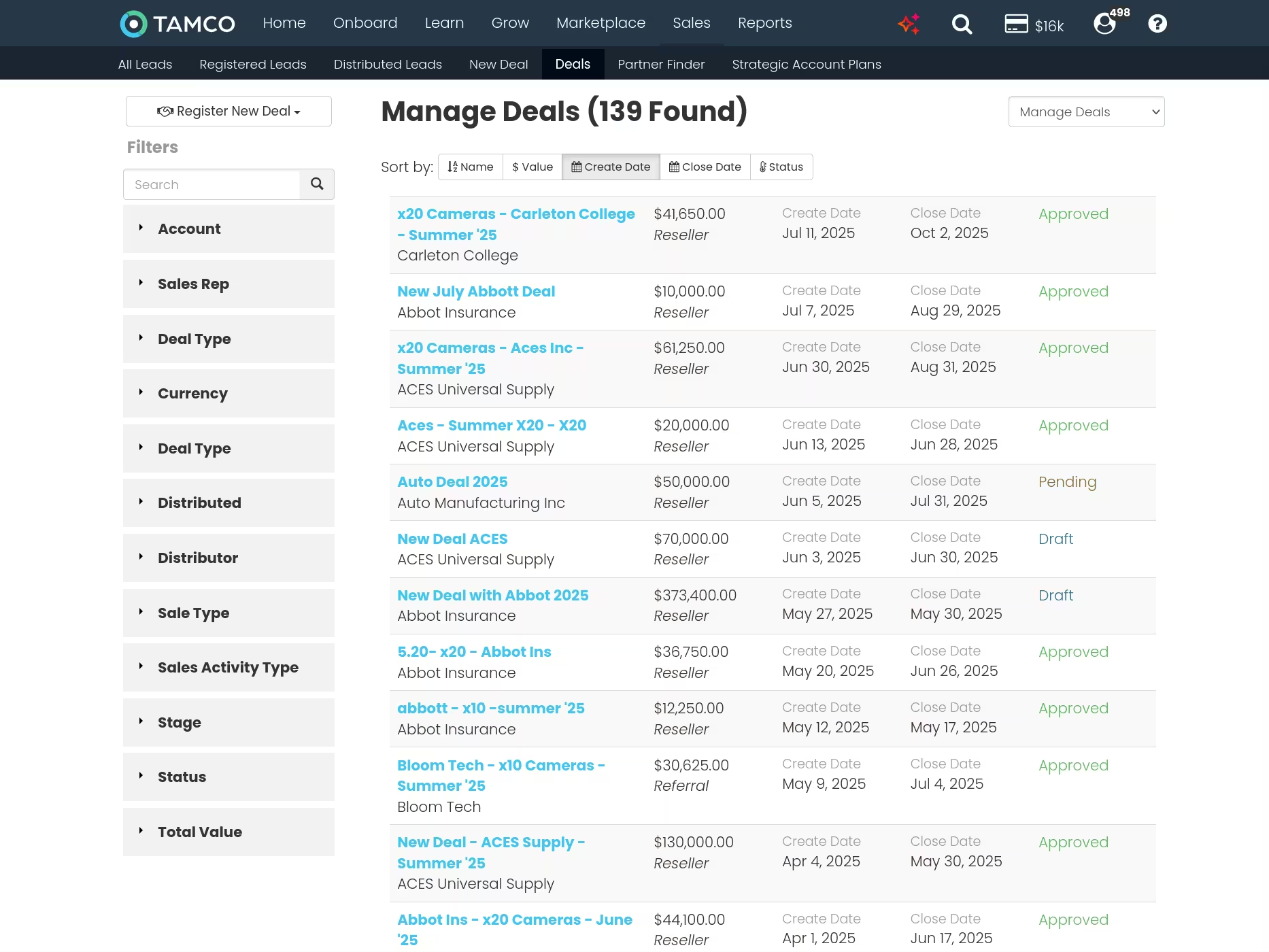

At its most basic level, your channel program exists to generate revenue, which means pipeline management becomes essential for tracking the deals your partners are working on and ensuring those deals progress toward close. Deal registration is a cornerstone of this process: partners register opportunities they are pursuing, which protects them from conflict with other partners or your direct sales team while giving you visibility into partner activity and helping you forecast channel revenue.

Lead distribution works in the other direction: when your company generates leads that should be served by partners (often based on geography or customer segment), those leads need to be routed to the appropriate partners with context about what the customer needs. PRM platforms automate this routing based on rules you define.

Marketing support

Many channel programs provide marketing support to help partners generate demand in their local markets, which might include co-branded marketing materials, market development funds (MDF), and access to marketing automation tools. MDF programs allow partners to request funding for marketing activities, submit proof of execution, and receive reimbursement. Administering these programs manually is error-prone and time-consuming. PRM platforms provide structured request and approval workflows, fund tracking, and ROI measurement.

Through-channel marketing automation takes this further by enabling partners to execute campaigns directly from the PRM platform. Partners can send co-branded emails, post to social media, or syndicate content to their audiences without needing their own marketing infrastructure.

Performance management

As your partner program matures, you need mechanisms for differentiating between partners who are performing well and those who need additional support or, in some cases, removal from the program. Partner tiering creates structured levels within your program, each with different requirements and benefits. A partner might start at a basic tier, earn promotion to higher tiers by meeting revenue thresholds or certification requirements, and receive additional benefits like better pricing or priority support at each level. Incentive programs motivate specific behaviors: selling particular products, completing training, or hitting quarterly targets. PRM platforms track eligibility, calculate rewards, and communicate program status to partners.

Communication

Underlying all of these stages is the need for ongoing communication: partners need to know about product updates, program changes, new resources, and upcoming opportunities, while you need visibility into partner activities, challenges, and feedback. PRM platforms provide communication tools including news feeds and targeted notifications, with segmentation ensuring that partners receive communications appropriate to their tier or specialization rather than a firehose of irrelevant updates.

Effective partner communication requires striking a balance. Too little communication and partners feel neglected, missing important updates that affect their ability to sell. Too much communication and partners tune out, treating your messages as noise. A dedicated channel account manager is often responsible for the high-touch relationship work, but PRM software ensures that even partners who do not have frequent human contact stay informed and engaged.

PRM vs. CRM: understanding the difference

The abbreviations are similar, and some of the underlying concepts overlap, but partner relationship management (PRM) and customer relationship management (CRM) serve fundamentally different purposes.

CRM platforms manage relationships with customers. They track contacts, log interactions, manage sales pipelines, and support marketing campaigns directed at end buyers. When your sales representative calls a prospect, they reference information in the CRM. When your marketing team segments an email campaign, they pull data from the CRM.

PRM platforms manage relationships with partners, who are themselves businesses that sell to or influence end customers. The relationship is structurally different. Partners collaborate with you to reach customers you could not serve efficiently on your own (though some distribution models also involve wholesale purchases).

The features of a PRM platform reflect this difference:

- Tracks individual contacts

- Manages direct sales pipeline

- Supports lead nurturing for prospects

- Measures customer lifetime value

- Tracks partner organizations

- Manages partner deals and registrations

- Supports enablement for partners

- Measures partner performance and contribution

That said, PRM and CRM platforms are complementary; in most organizations, both systems exist and exchange data. A typical integration works as follows: a partner registers a deal in the PRM, that deal syncs to the CRM where your sales operations team can track it alongside direct opportunities, and when the deal closes, the outcome flows back to the PRM for performance reporting and incentive calculation. If you have a partner program of any scale, you likely need both systems, and the practical question is how to architect the integration so that data flows where it needs to without creating manual reconciliation work.

Types of channel partners

Channel programs involve many different types of partners, each with distinct business models and expectations. Understanding these partner types helps you design program structures that fit their needs.

Transactional partners

Resellers purchase your products (or are authorized to sell them) and sell them to end customers. Value-added resellers (VARs) bundle your products with additional services, customization, or complementary solutions. These partners typically need deal registration to protect their opportunities, pricing and quoting tools, and marketing materials they can share with customers. VARs may also need technical training and certification to ensure they can deliver the services they bundle with your products.

Distributors operate between manufacturers and resellers, handling logistics and inventory. They often manage credit and billing as well. In a two-tier channel model, you sell to distributors who sell to resellers who sell to end customers. Distributors have different PRM requirements than direct resellers: they need tools for managing their own downstream partners, volume pricing and rebate calculations, and inventory visibility.

Service partners

System integrators build complex solutions by combining products and services from multiple vendors. Global system integrators (GSIs) like Accenture, Deloitte, and IBM work with enterprise customers on large-scale implementations. Smaller regional integrators serve mid-market customers with similar but more localized offerings. System integrators typically prioritize technical depth over transactional volume. They need access to technical training, reference architectures, and sales engineering support. Program incentives might emphasize certifications and customer satisfaction over pure revenue metrics.

Managed service providers (MSPs) deliver ongoing services to their customers, often including infrastructure management, security monitoring, or application support. They may resell your products as part of their service offering or simply use your products in delivering services to their customers. MSPs often have subscription-based business models, which requires PRM platforms to handle recurring revenue tracking and renewals rather than one-time transactions.

Referral and influence partners

Referral partners do not sell your products directly; instead, they introduce you to potential customers and receive compensation when those referrals convert. Affiliates are similar but typically operate through digital channels, driving traffic to your website through links and content. These partners need referral registration and tracking, commission calculation, and performance visibility. Consultants and advisors influence purchasing decisions without directly participating in transactions. A consultant might recommend your product to their clients as part of a technology strategy engagement; these influencer relationships are often managed through referral programs or informal arrangements, and the value is in their credibility with customers rather than their ability to close deals.

Technology partners

Technology partners build integrations between your products and theirs. These partnerships are often non-transactional: neither company is directly selling the other’s products. Instead, the integration creates mutual value by making both products more useful to shared customers. Technology partner programs focus on co-marketing, joint solution development, and ensuring interoperability. The PRM requirements differ from reseller programs, emphasizing solution documentation and marketplace listings over deal registration.

Finding and recruiting the right partners

Not every potential partner is a good fit for your program. Recruiting the wrong partners wastes resources and can damage your brand if those partners fail to serve customers well.

Defining your ideal partner profile

Before you begin recruiting, clarify what you are looking for. Consider these dimensions:

Customer access: What customers can this partner reach that you cannot serve efficiently through other channels? Geography, industry vertical, and company size are common segmentation factors.

Capabilities: Does the partner have the technical skills, sales capacity, and operational maturity to represent your products effectively? A partner who cannot deliver on customer expectations creates problems for everyone.

Commitment: Is this partner willing to invest in the relationship? Training their staff, integrating your products into their offerings, and promoting your solutions alongside (or instead of) alternatives requires real commitment.

Cultural fit: Can you work with this organization? Partnerships involve ongoing collaboration, and fundamental misalignment in values or business practices creates friction.

Evaluating potential partners

Once you have defined your ideal profile, you need to assess whether specific candidates match it. This evaluation involves both research and conversation: research their existing business to understand what products and services they offer, who their customers are, what their reputation is in the market, and whether they already work with competitors. Conversations reveal what research cannot: how do they think about their business, what are they hoping to gain from a partnership with you, how do they make decisions, and what resources will they dedicate to the relationship? The evaluation should be mutual because strong partners have options and are evaluating you as much as you are evaluating them.

Your partner value proposition

Why should a partner work with you? The answer needs to go beyond “our products are great.” Partners want to know how the relationship benefits their business.

Consider the economics of the partnership. How will partners make money? Direct margin on product sales is only one component. Partners also value opportunities to sell services around your products, ongoing maintenance or subscription revenue, and access to customers who might buy other things.

Consider the support you will provide. Partners need marketing support to generate demand, sales support to close complex deals, and technical support to implement solutions. The strength and accessibility of your support organization matters.

Consider your competitive position. Partners who already represent multiple vendors in your category will compare your program to alternatives. What makes yours worth prioritizing?

Key PRM software features

The PRM software market includes products that range from simple partner portals to extensive platforms covering every aspect of partner program management. Understanding the core feature categories helps you evaluate what you actually need.

Partner portal

The partner portal is the primary interface for your partners, where they log in to access resources, register deals, check their performance, and engage with your program.

A good partner portal is easy to navigate. Partners do not have exclusive relationships with you; they manage relationships with multiple vendors, each with their own portal. If your portal is confusing or cumbersome, partners will avoid it, which means they will miss information and you will lose visibility into their activities. Customization also matters because different partners need different experiences: a global VAR and a regional referral partner have different priorities, so the portal should present relevant content to each based on their partner type, tier, geography, or other segmentation.

The balance between self-service capability and available support is important. IFS, a global enterprise software company, described their portal experience this way:

“As a customer, IFS could do nearly everything needed for our updated portal re-launch on our own. Unifyr complemented us with guidance, best practices, and help where needed.”

— Sabine Zink Claesson, VP, Global Partner Operations, IFS

Onboarding and learning management

Onboarding new partners is where many programs lose momentum, as weeks can pass between signup and the point where a partner completes training, accesses resources, or registers their first deal. Structured onboarding workflows reduce this time to productivity, while learning management features allow you to create training content, organize it into courses, track completion, and issue certifications. For technical products, certification requirements ensure that partners have demonstrated competency before they represent your solutions to customers. Integration with external LMS platforms is valuable if you have existing training infrastructure, but many organizations find that a built-in LMS within the PRM reduces friction for partners who would otherwise need to manage yet another login.

Deal registration and pipeline management

Deal registration protects partners from channel conflict and provides you with visibility into partner activity: when a partner registers an opportunity, they claim it as theirs, which prevents other partners or your direct sales team from pursuing the same customer. A good deal registration system is simple enough that partners actually use it, because if the process requires excessive data entry or navigating multiple screens, partners will skip it entirely.

Pipeline management extends beyond registration to track deals through their lifecycle: what stage is each deal at, when was it last updated, and which deals are stalled and might need attention? This visibility supports forecasting and helps you identify where partners need support.

Lead distribution

When your marketing efforts generate leads that should be served by partners, those leads need to reach the right partners quickly, and lead distribution automates this routing based on rules you define.

Rules might consider:

- Geography: route leads from Germany to German partners

- Customer segment: route enterprise leads to partners with enterprise capabilities

- Partner capacity: limit how many leads each partner receives

- Partner performance: reward high performers with more leads

Partners expect rapid lead distribution because a lead that sits in a queue for days loses value as the prospect’s interest cools; automation ensures that leads reach partners while they are still fresh.

Content management and through-channel marketing

Partners need access to current marketing materials, product documentation, pricing information, and sales tools, but a disorganized content library wastes their time and risks them using outdated materials. Structure your library so that partners can find what they need through categorization by product, use case, or content type, with search functionality that is genuinely useful rather than just keyword matching.

Through-channel marketing automation (TCMA) enables partners to execute marketing campaigns using your content and infrastructure. Partners can send co-branded emails, post to social media, or run digital campaigns without needing their own marketing tools. This is particularly valuable for smaller partners who lack marketing resources. A reseller with three employees cannot build email nurture campaigns from scratch, but they can execute campaigns you have created and personalized for their audience.

Channel marketing automation extends your reach into markets you could not address efficiently with your own marketing team. Partners bring local relationships and credibility; you bring content and infrastructure.

MDF and incentive management

Market development funds help partners invest in marketing activities they could not otherwise afford, while incentive programs motivate specific behaviors like selling particular products or completing certification.

Administering these programs manually is painful because MDF programs involve fund allocation, request submission, approval workflows, proof of performance, and reimbursement, while incentive programs require tracking eligibility, calculating payouts, and communicating status to partners. PRM platforms provide the structure to manage these programs at scale, and the data they capture is valuable in its own right: when you can tie MDF spend to pipeline and revenue, you can identify which marketing activities generate returns and adjust your investment accordingly.

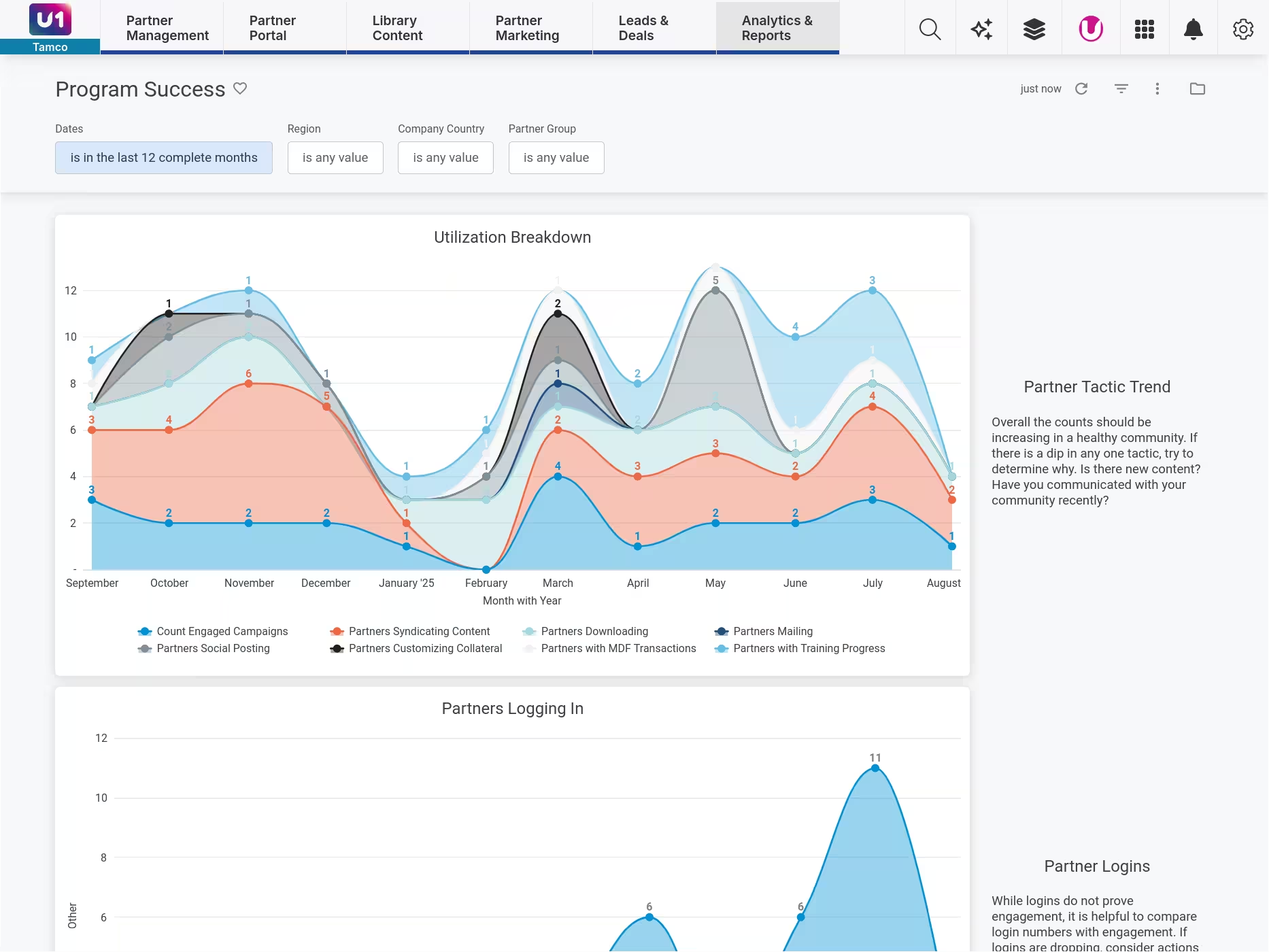

Analytics and reporting

Analytics within your PRM platform provide visibility into program performance, partner activity, and revenue contribution, giving you the data you need to identify what is working and what requires attention.

Standard metrics include partner recruitment and activation rates, deal registration volume, pipeline and closed revenue by partner, training completion, and content engagement. More sophisticated analytics tie these metrics together to identify patterns: which partner characteristics predict success, which content correlates with deal progression, where partners are getting stuck. Executive reporting matters because partner programs need internal advocates, and demonstrating channel contribution to revenue helps secure continued investment in the program.

CRM integration

Integration between PRM and CRM systems is essential: at minimum, deal registration data should flow to the CRM so that your sales operations team has complete pipeline visibility, though more extensive integration might include contact synchronization, activity logging, and automated status updates. The quality of the integration matters, because a PRM platform that claims CRM integration but requires extensive custom development to make it work has limited value. Look for platforms with pre-built connectors to your CRM platform and clear documentation about what data flows where.

Evaluating PRM platforms

The PRM software market includes vendors ranging from small startups to large enterprise platforms. Selecting the right platform requires clarity about your current needs and future trajectory.

Program complexity: What kind of partners do you work with? A program consisting entirely of referral partners has different requirements than a program with resellers, distributors, and system integrators. How complex are your deals? Some programs involve straightforward transactions. Others involve multi-partner deals where several organizations contribute to a single opportunity. Not all PRM platforms handle complex deal structures well.

Scale and growth: How many partners do you have today? How many do you expect in three to five years? PRM is typically unnecessary for programs with fewer than twenty partners. At that scale, spreadsheets and email work adequately. As you scale past fifty, a hundred, or several hundred partners, the administrative burden of manual processes becomes unsustainable. Choose a platform that can grow with you rather than one you will outgrow and need to replace.

Geographic and integration requirements: If your partner program spans multiple countries or regions, you need a platform that handles localization: language support, currency handling, and the ability to segment content and communications by geography. Your PRM also needs to exchange data with your CRM, possibly your marketing automation platform, perhaps your ERP system. Evaluate integration capabilities carefully.

Total cost of ownership: Software licensing fees are only part of the cost. Consider implementation costs (configuration, data migration, integration development), training costs, and ongoing costs (support, maintenance, upgrades). The cheapest platform by licensing cost may be expensive to implement and maintain. Independent assessments like the IDC MarketScape provide useful reference points when comparing platforms; Unifyr was named a Leader in the 2025 IDC MarketScape for Worldwide Partner Relationship Management Applications.

Measuring partner program success

A PRM platform provides data, but data without interpretation is just numbers, so you need to define what success looks like for your program and measure against those definitions.

Recruitment and activation: How many new partners are joining the program? Are you attracting the type of partners you want? Of partners who join, how many become productively engaged? Activation might be defined by completing onboarding, registering the first deal, or achieving first revenue. A program with high recruitment but low activation suggests problems with partner selection, onboarding, or your value proposition.

Enablement: What percentage of partners complete required training? How long does it take? How many partners achieve certifications? Which resources are partners using, and which are they ignoring? Content engagement data helps you improve your library over time.

Pipeline and revenue: How many deals are partners registering? Trends over time indicate program health. What percentage of registered deals close? Low close rates might indicate poor lead quality, inadequate sales support, or unrealistic partner expectations. Partner-sourced revenue (deals partners brought to you) is the clearest measure of partner contribution. Partner-influenced revenue (deals where partners played a supporting role) is harder to track but often represents significant value.

Program health: What percentage of partners remain active year over year, and are they advancing through your tier structure? High churn suggests dissatisfaction, while progression indicates that partners are genuinely invested in the relationship.

The role of AI in partner management

Artificial intelligence has become a standard feature in enterprise software, and PRM platforms are no exception. The practical question is which AI applications actually help and which are marketing distractions.

Content recommendations are among the most mature AI applications in PRM: when a partner searches for resources, an AI-powered system can go beyond keyword matching to understand intent and surface relevant materials the partner might not have found on their own, reducing time spent searching and increasing the likelihood that partners use the right content. Chatbots and virtual assistants handle routine partner inquiries about program policies, technical questions, and account information; when implemented well, these tools provide instant responses to common questions and free your partner management team to focus on more complex issues. Predictive analytics identify patterns in partner data that humans might miss: which partners are at risk of disengagement, which deals are likely to stall, and which partners are ready for tier advancement.

Agentic AI represents a newer application where AI systems take actions rather than just providing information or recommendations: an AI agent might proactively reach out to partners who appear to be struggling with onboarding, or automatically generate social content for partner syndication. These capabilities are genuinely useful, but they are early in their development, so expectations should be calibrated accordingly.

AI capabilities also raise legitimate questions about data handling, since partner data and customer information flowing through your PRM platform should remain confidential. Before adopting AI features in any PRM platform, understand the data architecture: Is your data used to train models that serve other customers? Is data processed by third parties? At Unifyr, our Responsible AI Policy addresses these concerns directly, with customer data isolated, never intermixed, and never accessed by third parties.

A channel program that has outgrown manual processes needs systems to manage complexity. Partners who struggle to find resources, register deals, or understand their standing in your program will direct their energy toward vendors who make it easier to do business.

If your current approach to partner management is creating friction, or if you are losing visibility into partner activities because information is scattered across spreadsheets and email threads, it may be worth evaluating PRM solutions more seriously. We are happy to have that conversation.